how to reduce taxable income for high earners australia

Negatively gear your investment property to reduce your taxable income. In Australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates.

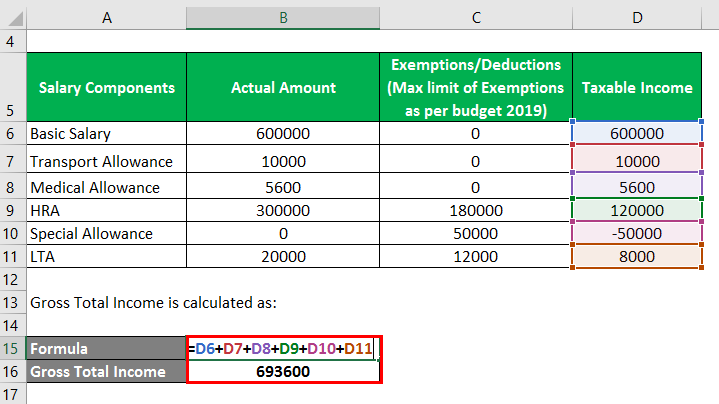

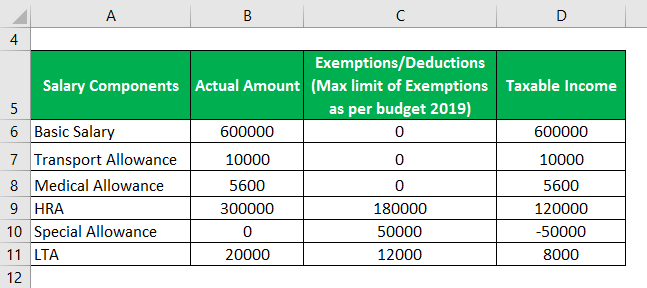

Taxable Income Formula Calculator Examples With Excel Template

Create an appropriate offsets policy.

. The taking care of your partners assets. In australia the tax laws make it so that the highest earners of the country are taxed at unbelievably high rates. Tax Strategies For High Income Individuals How to reduce taxable income for high earners.

Tax avoidance and evasion on the other hand is illegal and attracts heavy penalties from the Australian Tax Office ATO. What Is A High Income Earner In Australia. High Income Financial Planning Reduce Tax and Build Wealth.

A discretionary family trust can be beneficial for high income earners who are seeking to redistribute some of their income to family members on lower tax brackets. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Among the top 10 high-income earners surgical professionals lawyers chief executives and miners made up the majority.

Superannuation contribution options to reduce taxes. Invest in an investment bond to minimise your taxable income. Effective tax planning with a qualified accountanttax specialist can help you to do that.

Salary sacrificing super Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead. If you are an employee and you have an employer-sponsored 401 k or 403 b in 2018 you can contribute up to 18500 per year of your gross income. Next if eligible high income earners should fully fund a health savings account each year to further shelter income.

The ATO is far more likely to. To do this first they declared their total income from multiple sources such as wages bank interest and dividends from shares. Tax deduction versus tax offset The ATO considers some expenses as valid ways to reduce tax payable however how and when the reduction is applied on the assessable income depends on the type of expense.

Buying a new desk to use at home could also be a work-related expense particularly during COVID. A DRG deductible gift recipient is an ATO recognised organisation or fund that can receive tax-deductible gifts. These penalties can range from fines to imprisonment for more.

If you are a high-income earner it is sensible to implement tax minimisation strategies. Bonds for municipal projects are an excellent option You may sell inherited real estate Establishing a donation-advised fund will benefit your organization. How Can A High Earner Reduce Taxable Income In Australia.

The amount of offsets you get from your taxes Having a smaller capital gains tax CGT liability. A median taxable income was 55829 for Australian men in 2018-19 compared to. Conversions of Roth IRAs into a 401k.

401 k or 403 b. The scenario is the husband runs a business and earns a good 130k profit. Deductions that can be itemized from your income.

Forty-five of those millionaires were able to reduce their taxable income down to below the tax-free threshold of. A discretionary trust would be used for distributing business profits investments. Some things crossover between work and life.

The amount left was their taxable income. Make spousal contributions to reduce your tax liability. Your capital gains tax CGT liability will be reduced.

How Do High Income Earners Reduce Taxes. Consider salary sacrificing to reduce your taxable income. There are many strategies to help you maximize your charitable contributions and reduce your income tax.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Then they subtracted deductions such as work expenses and charitable donations. Some of Australias highest earners pay no tax and it costs them a fortune.

According to an analysis of countries around the world by Price Waterhouse Cooper Australia is ranked nearly at the top of tax rates for high-income earners. How Do High Income Earners Reduce Taxes Australia. 50 Best Ways to Reduce Taxes for High Income Earners 1.

Putting your spouses name on assets. How to Reduce Taxable Income Through Charitable Donations. Main residence The main residence capital gains tax concessions are arguably the most valuable tax break in Australia for building personal and family wealth.

Take Home Rates for an annual income of 400000. Reduce the income tax paid on dividends through franking credits. How to reduce taxable income for high earners.

A discretionary trust can be set up to receive company income. For taxable income levels between 180000 and 273000 the tax saving will be 34. Taxable income falls into five tax brackets.

For income levels between 273000 and 300000 it will be between 34 and 19 and for income levels above 300000 the saving will be 19. Contributions to your retirement should be made as much as you can. In a survey on income in Australia it emerged that male and female earnings are vastly different.

High-income earners can take advantage of the various tax deductions or offsets that the Australian Taxation Office ATO permits. Australians are using trust funds to minimise their taxable income to the tune of 35 billion a year according to a new report from the Australia Institute which found those who contribute the. This video gives a few suggestions on how to reduce taxable income.

High-income earners should consider donating low cost basis stock contributing to a donor advised fund or stacking future charitable donations in a single year to maximize tax deductions. This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. The tax benefit of salary sacrifice super contributions is now more significant with the higher individual tax rates.

Keep Accurate Tax and Financial Records. Most of our Sydney clients are in the top 15 of earners in Australia. Tax deductions you may want to maximize.

15 Easy Ways to Reduce Your Taxable Income in Australia 1. For example if you were an entertainment reporter you may be able to claim the cost of tickets to events. For those trying to learn how to save tax in Australia salary sacrificing is one way to do.

High Income earner in Australia have the most to gain from the financial rules and investment options if they have the right advice. Hold investments in a discretionary family trust for tax-effective income distribution. Individuals with a taxable income of between 50k and 250k tax brackets gain the most from this strategy due to the super tax rate 15 versus your marginal tax rate.

How do high income earners reduce tax in Australia. You are allowed to claim a tax deduction depending on the type of donation. One way to reduce your taxable income is to donate to a DRG organisation.

Taxable Income Formula Calculator Examples With Excel Template

How To Reduce Your Taxable Income Part 2 Itp Accounting Professionals

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Northern European Countries That Call Themselves Democratic Socialist Seem To Have Relatively Low Corporate Tax Rates And High But Flat Non Progressive Personal Income Tax Rates Is This Accurate What Else Do They

Good Morning Taxable Income Earners Everyone Wants To Reduce Their Tax Right So One Simple Way To Determine If You Ca Virtual Assistant Income Tax Deductions

Taxable Income Formula Calculator Examples With Excel Template

Reduce Taxable Income Smart Ways To Save More Money Easi Australia

What Is Taxable Income And How To Calculate It Forbes Advisor